Step-by-Step: Using the Calculator for Maximum Accuracy

Step 1: Select Your Region or Go Custom

Start by choosing your region from the dropdown. This automatically populates typical rates for your area.

Pro tip: Even if you select a preset, verify the rates with your actual utility bill. Regional presets are averages—your specific tariff might differ.

For "Custom" region, you'll manually enter export/import rates and can set currency symbols.

Step 2: Input Your System Specifications

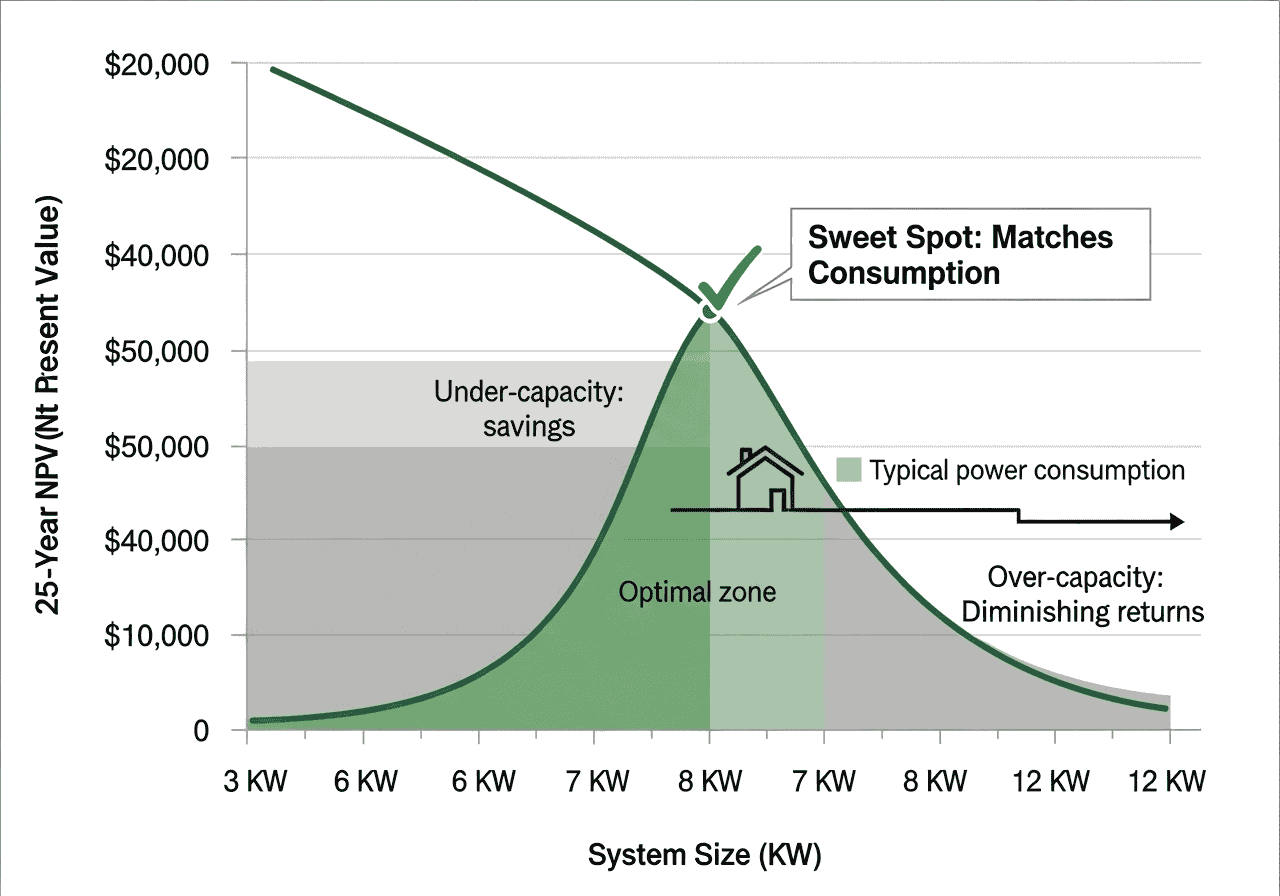

System Size (kW)

Check your solar quote or inverter capacity. Typical residential: 3-10 kW.

Cost Calculation

- Using Cost per kW: Enter average $/kW from quotes (typically $1,000-$2,500/kW in US after incentives)

- Manual Total Cost: Include batteries, installation, permits minus tax credits

Monthly Generation

Your installer provides this, or use tools like PVWatts. Varies by location, roof angle, shading.

Monthly Consumption

Check 12 months of utility bills, calculate average.

Step 3: Set Financial Assumptions

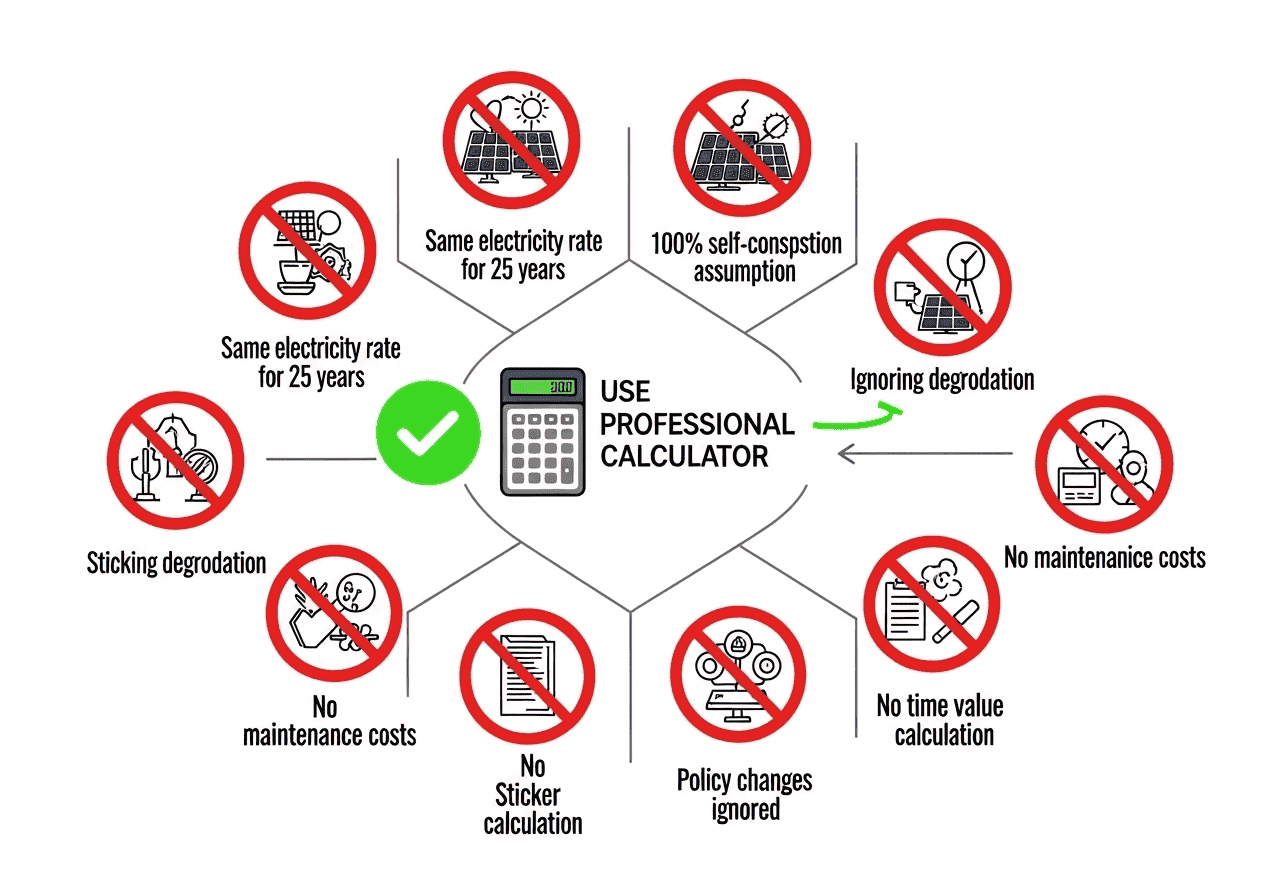

Degradation Rate

0.5% is standard for Tier 1 panels. Budget panels may degrade faster (0.7-1.0%).

Escalation Rate

Historical US average is 2-3%. California closer to 3-4%. Conservative estimate: 2.5%.

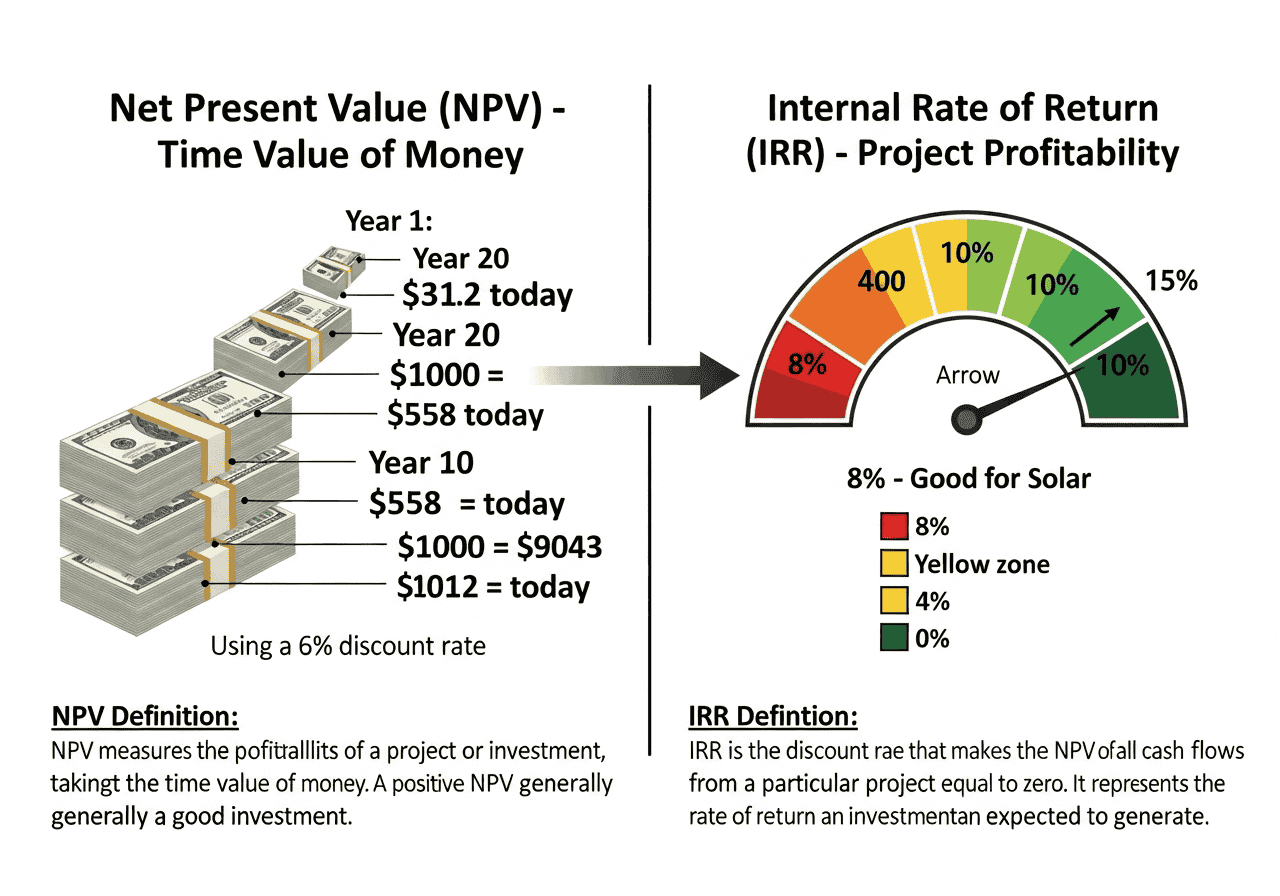

Discount Rate

Your opportunity cost of capital. If you'd otherwise earn 6% investing that money, use 6%. Higher rate = more conservative analysis.

Step 4: Optional - Configure 12-Month Profile

Click "Edit profile" to input seasonal multipliers. Example for Northern hemisphere:

- Winter (Dec-Feb): 0.85-0.9

- Spring (Mar-May): 0.95-1.0

- Summer (Jun-Aug): 1.05-1.1

- Fall (Sep-Nov): 0.9-1.0

The calculator normalizes these automatically.

Step 5: Calculate and Review Results

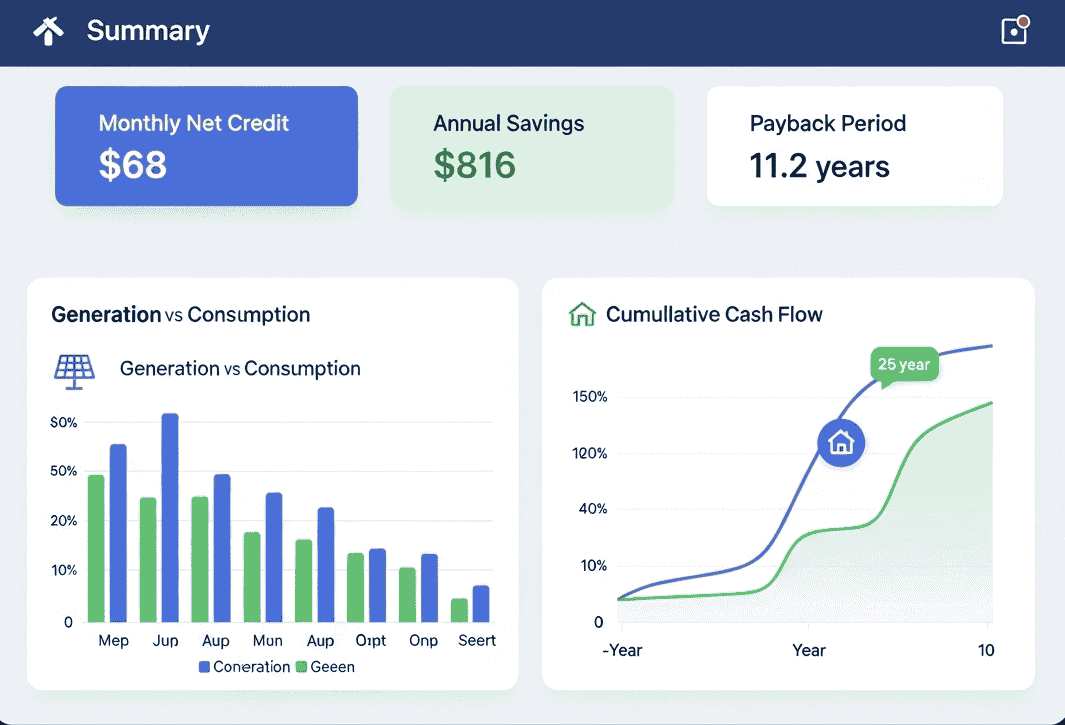

Hit "Calculate" to generate:

- Key Metrics Dashboard: Monthly net credit, annual savings, payback period

- Energy Balance Chart: Visual comparison of generation vs consumption by month

- 25-Year Cash Flow Chart: See when you break even and cumulative savings

- Detailed Projection Table: Year-by-year breakdown with exported/imported kWh and cumulative cash position